Unveiling the Dark Side of Cryptocurrency: How to Spot and Avoid Fraud in the Digital Currency World

- Steve

- Dec 11, 2024

- 3 min read

The world of cryptocurrency is thrilling, offering new technologies and the chance for big returns. Yet, this excitement also attracts fraudsters who prey on eager investors. As you dive into the digital currency market, knowing how to spot scams is critical. This knowledge can protect your investments and keep your finances secure.

Understanding Cryptocurrency Fraud

Cryptocurrency fraud comes in various forms, including Ponzi schemes, phishing attacks, fake Initial Coin Offerings (ICOs), and pump-and-dump schemes. Understanding these common types of fraud can empower you to safeguard your investments. The anonymity of cryptocurrency can make it a playground for scammers, so educating yourself on the tactics they use is essential. According to a report from Chainalysis, over $14 billion was stolen from cryptocurrency investors in 2021 alone, highlighting the real risks involved.

Common Types of Cryptocurrency Fraud

Ponzi Schemes

Ponzi schemes promise high returns, paying early investors with the money from new ones instead of profits. For instance, BitConnect was notorious for its Ponzi scheme, attracting thousands of investors before collapsing in 2018, leaving many with significant losses. If an investment offers exorbitant returns with minimal risk, it’s a major red flag.

Phishing Attacks

Phishing attacks trick you into sharing sensitive information like passwords. Scammers may send emails that seem to come from trusted exchanges, luring you to fake sites. In 2022, users reported losing approximately $2 million to phishing schemes targeting crypto wallets. Always check URLs carefully and avoid clicking unknown links.

Fake ICOs

Startups use Initial Coin Offerings (ICOs) to raise funds but the lack of regulation can lead to fraud. For example, in 2017, startup Centra raised $25 million through a fake ICO, claiming to partner with Visa and Mastercard without any legitimate backing. Always research any ICO thoroughly, looking for clear whitepapers and credible teams before you invest.

Pump-and-Dump Schemes

These schemes artificially inflate a cryptocurrency’s value through hype. Scammers promote a coin until prices spike, then sell off their holdings, leaving unsuspecting investors with worthless tokens. In 2021, a pump-and-dump involving the cryptocurrency SafeMoon saw prices soar before crashing by 80%, costing many investors dearly. Evaluate any coin based on its fundamentals rather than following hype.

Red Flags to Watch For

Being alert to potential fraud is vital. Here are some key signs to consider:

Lack of Transparency

Legitimate projects openly share information about their teams and technology. If a project lacks clear details and is secretive about its goals or structure, be cautious.

High Pressure Tactics

Scammers often rush you into investing quickly by suggesting the opportunity is limited. If someone insists you act fast, take a step back and think it through.

Unrealistic Promises

If an investment boasts astonishing returns with no risk, it’s likely a scam. High returns usually come with high levels of risk.

Anonymous Team Members

While some successful projects operate with anonymity, most scams involve unknown figures. Verify the credentials of those behind any cryptocurrency project.

Unregulated Exchanges

Trading on lesser-known or unregulated exchanges increases your risk. Stick to reputable platforms with a proven track record to minimize scams.

How to Protect Yourself

While preventing all fraud is impossible, there are proactive steps you can take:

Educate Yourself

Stay updated on common scams and tactics. Knowledge is your best defense. For instance, you might check resources from organizations like the Federal Trade Commission (FTC), which often provide updates on scams.

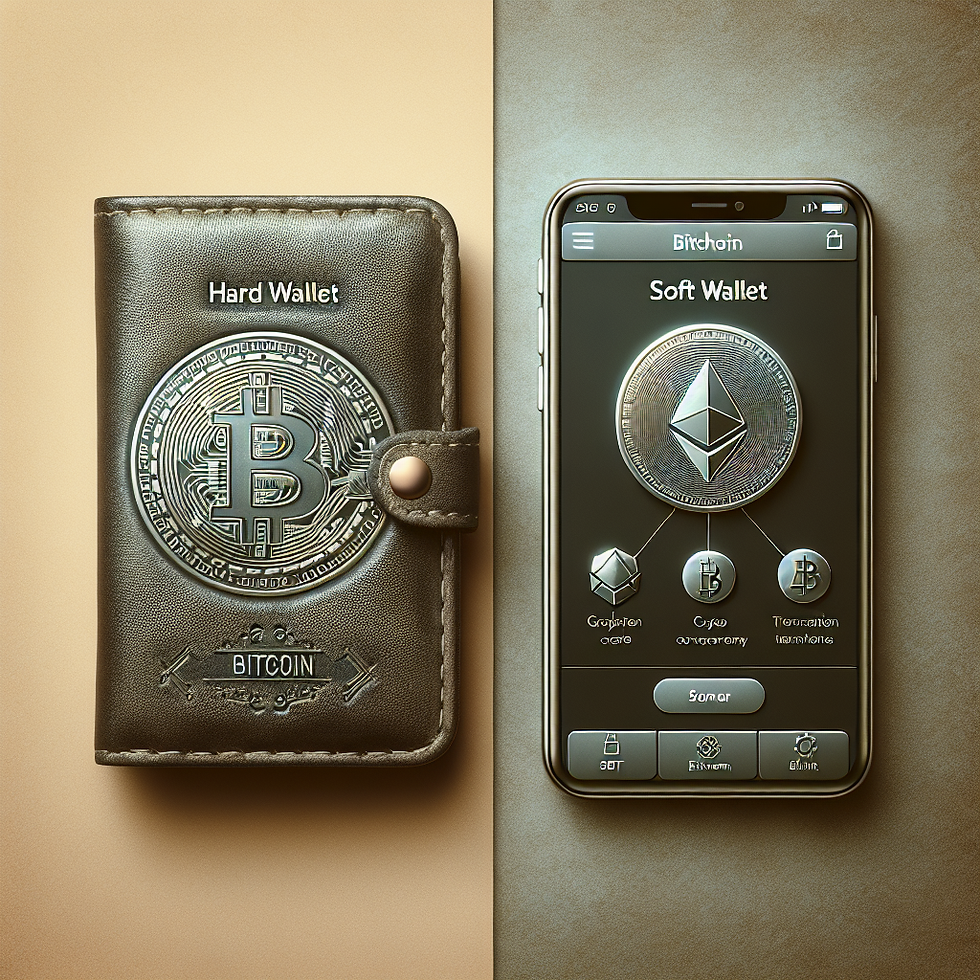

Use Reputable Wallets and Exchanges

Choose established cryptocurrency wallets and exchanges with positive reviews. Research their security features and regulatory practices before using them.

Enable Two-Factor Authentication

Adding two-factor authentication (2FA) to your accounts provides an extra layer of safety. This simple move can greatly reduce the risk of unauthorized access.

Diversify Your Investments

Do not invest all your funds in one cryptocurrency. Spreading your investments can help protect your finances and balance risks.

Seek Professional Advice

Consult financial professionals who have experience in cryptocurrency. Their expertise can guide you in navigating this complex landscape, minimizing the chance of losses.

Key Takeaways

Recognizing cryptocurrency fraud is essential in today’s digital landscape. Scammers are increasingly sophisticated, making it crucial for investors to stay informed. By understanding common fraud types, spotting potential red flags, and implementing protective measures, you can significantly lower the risk of falling victim to scams.

Embracing cryptocurrency's potential while exercising caution can lead to a more secure investment journey. The digital currency world offers promising opportunities, but a careful approach is vital to achieving your financial goals while staying safe.

Comments